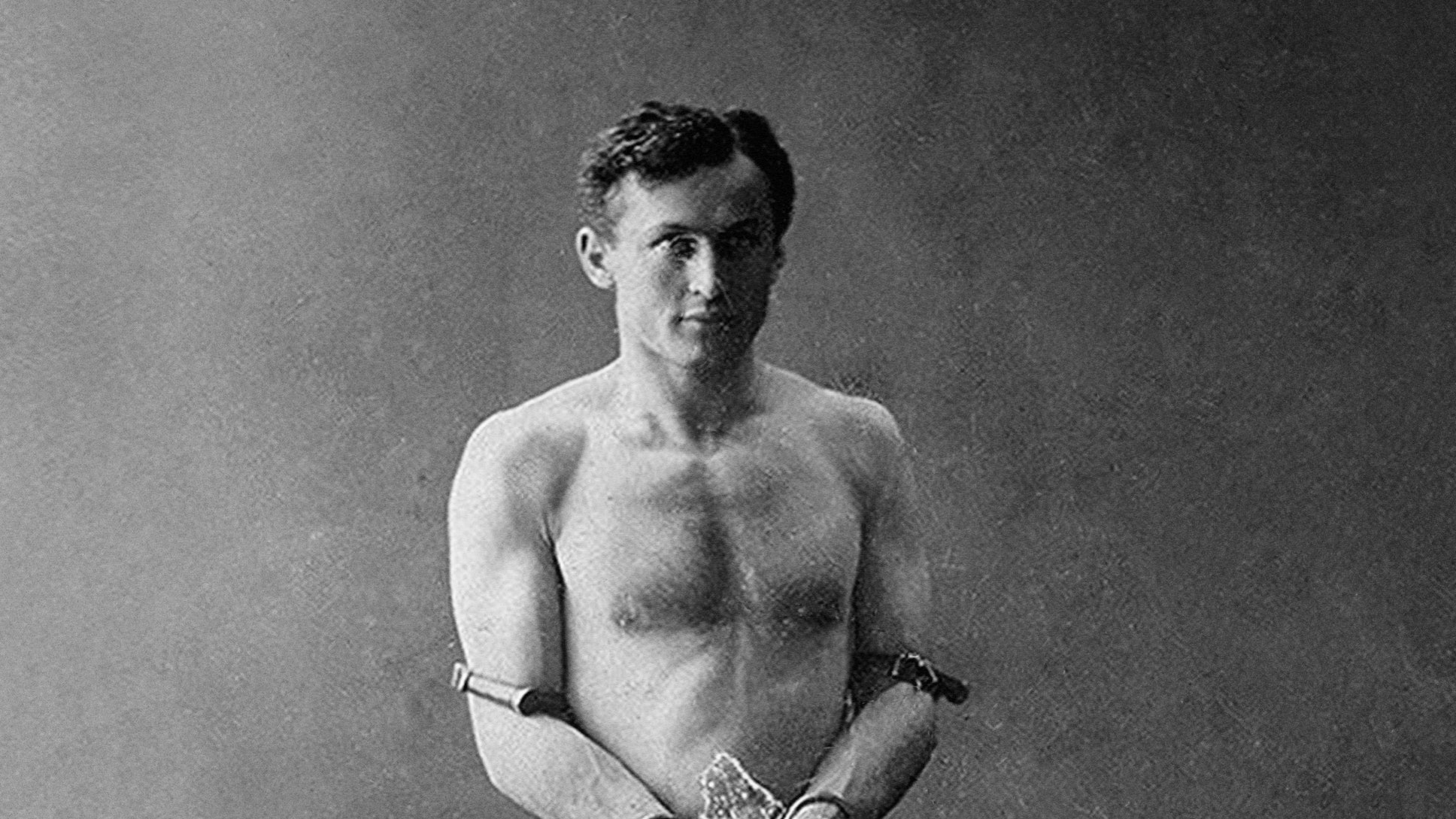

Harry Houdini was one of the greatest illusionists and escape artists we have ever known. While most know him for escaping perilous entrapments involving strait jackets, handcuffs and being submerged underwater, it was another act that led to his ultimate death.

Houdini claimed he could take a punch in the stomach from anyone. Accordingly, at the end of his shows he would routinely call up the biggest, strongest man from the audience and instruct him to hit him as hard as possible in the stomach. After one such show at McGill University, Houdini invited a few college students backstage to his dressing room. One of the young men asked Houdini if it was true that he could take a punch from anyone in stomach. Houdini, relaxing on a couch, acknowledged that it was true. The man then suddenly hit him in the stomach several times with forceful blows. Because Houdini had no time to prepare for the punches, the man inadvertently ruptured his appendix, which caused Houdini’s death a week later.

Last year was a hard, stressful one for the world that saw a 35% drop in the markets. It was a sucker-punch to the gut, a crisis not caused by systemic weaknesses or an eroding economy, but by a blow that no one saw coming. When we look at the history of the markets, it’s often the unexpected events like these that rattle markets the most. In 2020 it was COVID, and before that there were events like Lehman brothers not finding any buyers, the Flash Crash, Black Monday, etc. These events often leave the markets reeling much more so than the ones we see coming. The markets have gone through the past two elections without much of a hiccup, and they endured the terrible unemployment and earnings data from COVID rather well because we pretty much knew they were coming at that point.

Much like Houdini, the markets can take a very strong punch to the gut, but only if they see it coming. That should be encouraging as we think through the uncertainty of when vaccines will offer some sort of herd immunity, how a Democrat-controlled government will affect the economy and taxes, or a myriad of other concerns that you might be thinking through. These are issues that the markets and investors know about and are mostly factored in already to the current prices of stocks. When we look back, it will likely not be these issues that cause a huge disruption to the stock market. Instead it’s likely going to be something that literally no one is talking about right now that has the biggest effect on the stock market in 2021.

Of course, that can be pretty discouraging because it means that we’re able to get the wind knocked out of us at any moment by something we can’t predict nor do anything about! Will it be pandemic-related, political, economic, or something totally out of left field? No one knows. Remember that! No one, not even the smartest prognosticators, know the forces that will truly control the markets in 2021. That means that you certainly don’t have to have it all figured out either. It reminds me of James 4:13-15:

Now listen, you who say, “Today or tomorrow we will go to this or that city, spend a year there, carry on business and make money.” Why, you do not even know what will happen tomorrow. What is your life? You are a mist that appears for a little while and then vanishes. Instead, you ought to say, “If it is the Lord’s will, we will live and do this or that.”

You probably felt like you took some big punches to the stomach last year and would care to pass on any more. And while that may be true in life, most of you did phenomenally well with your investments in 2020. That’s because while you can’t avoid the punches, you can keep your investments ready for them so you don’t get caught off guard. This is the main reason why you need to hold adequate amounts of conservative investments. So that when the next punch comes, you can take it in stride. Keeping enough in bonds and cash might feel unproductive at times, but it allows you to weather the toughest of storms. So long as you don’t sell your stocks in the middle of the drop, you can walk away mostly unscathed. That’s how you can end up with a positive 18.4% return on the S&P 500 Index despite a 35% drop!

The other main way to prepare for the punch is to get your mind right. The fact is that our main enemy in investing is not volatility, but our own emotions! Keep a long-term perspective on things. Remember that the future has always been uncertain, there have always been economic and political concerns, and there is a God who is good and in control of it all. Remind yourself that if the Lord wills, we will live and do this or that.

BACK TO NEWS