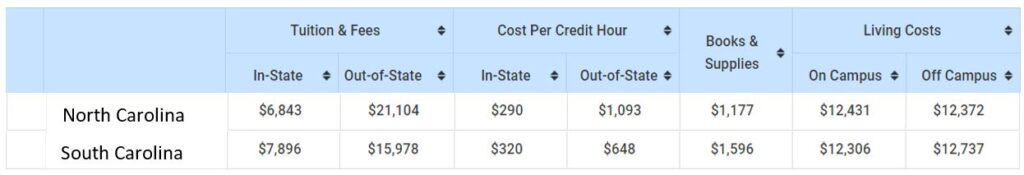

As you may have guessed, college costs continue to rise, above and beyond inflation. The numbers get more and more startling and almost make you want to pretend they are not reality. But they are reality and the more information we have, the better we can be prepared for the future. Here’s the breakdown of what you can expect on average in North Carolina and South Carolina (taken from www.collegetuitioncompare.com):

As you can see, the average total in-state cost for one year of public college is $20,451 in NC (on-campus) and $21,798 for SC. For private school, the cost jumps to $36,085 and $32,517, respectively. For more elite schools such as Davidson and Duke, the cost can exceed $69,000!

College inflation continues to outpace general inflation as well. Over the past five years, costs for college in NC have risen 10% above inflation over that time period, and 11% in SC, for an average of slightly under 2% per year.

For a father of four, this tempts me to want to panic! Thankfully, there are options to make college more affordable. For starters, there are scholarships abounding. CollegeScholarships.org lists 23,041 scholarships available, many of which go unclaimed ever year. You can filter these by several different search criteria. Other options include earning general credits while in high school, taking a year or two at a local college and then transferring, taking classes on-line, CLEP exams (there are 33 courses for which you can take an online exam and receive college credit at a cost of $85!).

College may not be the right option for every child, either. We tend to make it the default option for high school graduates, rather than the true higher education that it was originally intended to be. While many employers require a degree, not all great careers need one and more important to many employers are character traits such as being humble, hungry, and quick to learn.

With all of that said, the most common goal that I hear from parents is to be able to pay for the cost of four years of public in-state college education. If that is your goal, then the big lesson is to start saving today! Make sure you don’t neglect saving for retirement, but every year really counts. If you were to fully cover that cost of NC college, and didn’t receive any help, you would need to start saving around $500/mo from the first year of birth! You can get your own custom estimate here.

Regardless, remember not to panic. Scripture instructs us to not be anxious about anything, and that includes paying for college. We’d be better off focusing on training our children and making sure they’re ready for adulthood than we would be focusing on paying for college. Most of their real education will be over by then anyway!

BACK TO NEWS