While the stock market had a terrible year last year, bonds didn’t do much better. In fact, when you look at it on a risk-adjusted basis, bonds were much worse. The S&P 500 lost 19.44% in 2022, while the Barclay’s Aggregate Bond index was down 13.0%. While we expect stocks to go through rough stretches every so often, it’s usually during those same periods that investors look to their bonds to keep their portfolio afloat.

To put the bond return in perspective, this was only the third time recorded that bonds have lost any money when stocks were down more than 10%, and the only other two times were before 1942 and the loss was less than 3% each time. To say that last year was an anomaly is an understatement.

In 2023, bonds haven’t done themselves any favors. With the S&P 500 up over 17% YTD, bonds have been continuing a bit of a slow bleed, down around 1.75% for the year.

And with cash earning upwards of 5% with zero risk, it’s hard for many to make the case for investing in bonds. Why take on the added interest rate risk when you can get a risk-free rate of return of 5% on your non-stock investments? And what happens next for bonds?

The Fed is mostly done raising rates at this point, indicating that they may in fact raise them one (possibly two) more time(s) if needed, but with a target rate that begins to lower sometime early next year. As you’re likely aware, bond returns are inversely related to interest rate movements, so lower rates are like bonus returns for bonds. That’s why as the Fed has continued to rapidly raise rates, bond investors have been punished.

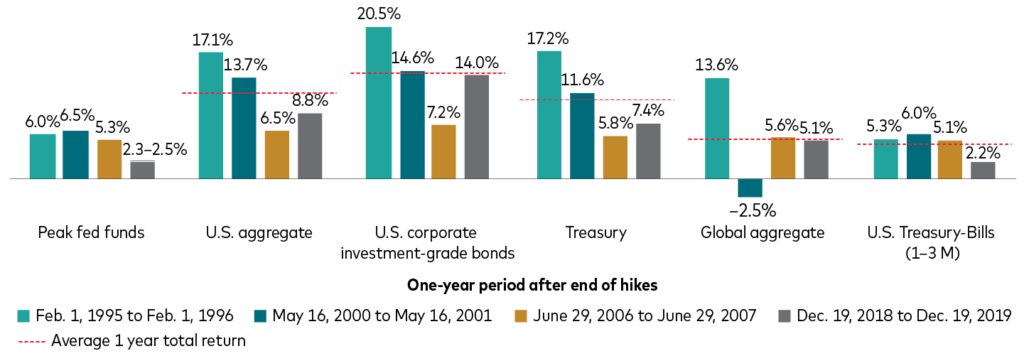

Once the Fed does stop raising rates, it can be a very good environment for bondholders. As you can see below, the one-year returns following Fed hikes can offer stock-like returns for bondholders who haven’t given up on beat-up bonds.

How bonds have responded after the Fed stopped raising rates

Another source of encouragement is the inverted yield curve you’ve heard about in the news. The yield curve gets inverted when the yield for 2-Year Treasuries is higher than 10-Year Treasuries. In a normal environment, you get paid more for loaning out your money for a longer time. But the lower 10-Year number points to a consensus projection that yields will be falling in the future. And future falling rates points to…you guessed it – higher returns for bonds.

So we certainly haven’t bailed on bonds. The big questions for us are “when?” and “how much?” We don’t know precisely what the Fed will do (nor do they at this point), nor do we know how sharply rates will lower. Forecasts are just that, and are subject to change just like weather forecasts.

What does seem highly likely is that the worst of the bond carnage is behind us. So at this point it’s mostly a waiting game. We can see the value in having some of your conservative investments in a bond-alternative like cash or shorter-term treasuries, but when you take too big of a gamble in either direction, it can often lead to more harm than good.

In the end, I’m reminded of Ecclesiastes 11:2: “Divide your portion to seven or even eight, for you do not know what misfortune may occur upon the earth”. Diversification makes sense as it always has. That doesn’t mean you shouldn’t be making some tactical changes, as we have been doing for our client’s portfolios. But it does mean that you shouldn’t put all your eggs in one basket, or abandon one basket that hasn’t gotten many eggs lately.

BACK TO NEWS