Our process draws out relevant Biblical principles and how to apply them practically to your situation.

Every situation is unique, but the questions you are facing are often very common and financial planning is a process to help find answers.

How much do I need for retirement?

How much should I be saving?

Should I pay off my mortgage?

If you have big questions like these regarding your finances, then financial planning is a great place to start.

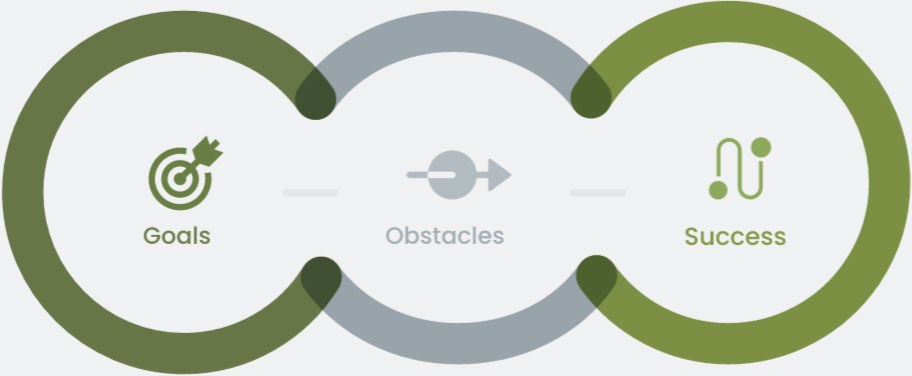

Identifying your specific goals

Detecting the obstacles in your way

Determining the most efficient and effective pathway to success

SHEPHERD offers free access to our financial tracking portal that allows you to track your progress in real time.

In fact, you don’t even need to be a client to take advantage of this opportunity.

Simply click below to create an account, follow the guided process to enter as much of your information as you want, and you can start tracking your progress today!

GET STARTED FOR FREEShepherd provides investment management services and designs portfolios that consider your unique goals, risk tolerance, and Values.

We’d be glad to provide you with a second opinion on your current investments, with no obligation.

Investing should always start with specific goals in mind.

Building wealth should never be an end in itself but rather a means to help accomplish your objectives as a steward.

We believe that there are many risks, from stock price volatility and market crashes to inflation and outliving your money.

Shepherd works with its clients to identify the most critical risks and invest in their portfolios to help increase the probability of success.

Our investments should also align with our convictions and values.

When you buy a stock or mutual fund, you become an owner of the underlying companies.

In addition to a focus on rates of return, Shepherd offers Biblically Responsible Investing to help consider the sources of our returns.

Biblically Responsible Investing describes an approach to investing assets in a way that is in alignment with Biblical beliefs.

As owners of our portfolio’s underlying companies, it is vital that Christians consider not only their rates of return, but also the sources of those returns.

Shepherd aims to:

Promote companies who are doing good to the world and blessing their customers and communities.

Protect values from being compromised by companies that seek to profit from immoral or exploitative practices.

Provide practical solutions to help investors align their portfolios with their beliefs and convictions.

At Shepherd, we’re great at 3 things – technical expertise, personal relationships, and biblical wisdom. We’re not perfect at any of them, but we continue to strive for excellence and do our best to treat our clients like we’d want to be treated. We’re committed to giving lots of personalized attention to our clients, and we desire to be the one person you call whenever you have a question that has to do with money and how it affects your relationships and future.

Our clients are typically in the stage of life leading up to retirement, or have already entered retirement, and are desiring help with investments, taxes, and other strategic planning. Our ideal client is desiring an advisor to come alongside and be a guide for their stewardship journey. We also enjoy serving small business owners and executives who have a slightly more complex situation.

We do not have a minimum amount of investments to manage, but we do have a minimum annual fee of $1,000.

Our financial planning fees are charged either hourly or as a flat fee based upon the complexity of the plan which is agreed upon up front. Our investment management fees are a quarterly fee based on a percentage of the assets we manage, which starts at 1% annually and gets lower after certain break points. We think this is the fairest way to charge fees as it keeps our interests mutually aligned with our clients and allows us to be objective in which investment solutions we recommend since our fee is never based on commissions.

We are legal fiduciaries and as such are required to keep your interests ahead of our own. We are regulated by the state of North Carolina as a Registered Investment Advisor.

We’re easy to work with. We often recommend starting with a quick phone call so you can tell us briefly about your situation and we can tell you about the client experience and make sure we’re a great fit. After that, we’ll sit down for a face-to-face meeting where we can collect information, help you begin organizing your financial world, and then we’ll start the fun behind-the-scenes work of analyzing, computing, and developing recommendations that will help you reach your finish line!

Not at all. We find that our best and highest value relationships engage us for both services, but we want to serve you in the way that seems best to you.

We believe that how you invest is critically important, as your investments will be the primary driver of your retirement cash-flows. We believe that it’s difficult but not impossible to beat the “market”, that we should keep fees low since they’re a headwind to investment returns, and that there is no one-size-fits-all solution. We have a variety of tools to utilize to help build a portfolio to match your desired investment experience.