This is by far the most popular question we get, so you are in great company if feeling uneasy as to the answer. Retirement is like an obstacle course race, with many challenges that will spring up along the way. However, if the right process is put into place, you can have the peace of mind to approach retirement with absolute confidence.

The first major obstacle to winning the retirement race is knowing where your financial finish line lies. Unlike a traditional race, the finish line for retirement is somewhat of a moving target since you don’t know what will happen in the future. You can’t know how long you will live, what your rate of return will be, or what inflation will be like, etc.

The good news is that you get to set your own finish line. You get to decide what sort of lifestyle you want to live and how long you are willing to work. If you are willing to spend a bit less per month, you could accelerate when you get to the finish line. I’ve found that simply reducing a client’s projected monthly expenses by as little as $300 can make their nest egg be expected to last 2-3 years longer. The same is true if you can increase the rate of return on your investments. Or if you aren’t in a rush to retire because you’re one of the lucky few who loves your job, then you can potentially ease up a bit knowing that you’re ahead of pace.

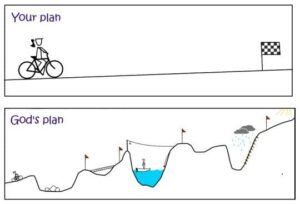

Regardless of where you choose to set the line, once you set it then you can determine if you’re ahead of pace or have some ground to cover. Be careful not to set it and forget it, though, because the reality is that life’s journey rarely takes the predictable path of a straight line, and just because you’re on pace today doesn’t mean that you necessarily will be tomorrow.

When planning for retirement, you should also be aware of the tendency toward pursuing “financial independence.” When we feel like we are financially independent, or at least on the way to it, we tend to become less dependent on God. Unintentionally, we begin to put our trust in what we have and what we can do to accumulate more. Slowly and stealthily, we begin putting our trust in the provision rather than in the Provider. As Proverbs 18:11 cautions, “The wealth of the rich is their fortified city; they imagine it an unscalable wall.” While financial independence and spiritual dependence are not mutually exclusive, it is with good reason that Jesus cautioned us that we cannot serve both God and Money.

“Suppose one of you wants to build a tower. Won’t you first sit down and estimate the cost to see if you have enough money to complete it?” (Luke 14:28)

Even though there can be many obstacles in trying to plan for retirement, there is tremendous value in one particular word Jesus uses in Luke 14:28 – estimate. When builders estimate, they scrutinize their known costs, factor in as many variables as they can, and then rely upon their well of experience (hopefully they’ve done this before!) to determine an overall estimate for a given project. Even though they don’t know exactly what will happen, they can often give a very precise estimate for the overall cost of completion.

We can similarly look at your lifestyle, goals, and current situation to see if your financial blueprint is reasonable. We can then estimate how much you should be setting aside each month to stay on pace, and what sort of investment strategy is likely to help you reach your finish line. Just as you likely wouldn’t attempt to build your own house, we recommend that you get the help of a professional to help put your financial house in order. If you’re interested in learning more about the financial planning process, we recommend starting by using this free financial planning software to get a picture of your current situation and financial trajectory.

BACK TO NEWS