They say that there’s only two certainties to life – death and taxes, neither of which are particularly pleasant to think about! As investors, and humans, we desire certainty. We want to know that there is a clear path to follow with our investments to so that our financial plan works out and we reach our long-term goals. Strategy A leads to Result B, which then leads to Outcome C. Yet as the Preacher of Ecclesiastes reminds us:

“If the clouds are full of rain, They empty themselves upon the earth; And if a tree falls to the south or the north, In the place where the tree falls, there it shall lie. He who observes the wind will not sow, And he who regards the clouds will not reap. As you do not know what is the way of the wind, Or how the bones grow in the womb of her who is with child, So you do not know the works of God who makes everything.” Ecclesiastes 11:3-5

Often its tempting to want to wait for the perfect time to invest, for when the stars align and the coast is clear. Conversely, uncertainty feels dangerous, risky, and even costly at times. And we can’t avoid it – it’s a part of life. It’s why we (rightly) buy insurance, why we have emergency funds, and why we have generators.

Investing is a great case study in the area of uncertainty. Investing is by nature giving up some money now in expectation of a higher future return later. And it’s because of all of the unknown things that can happen between now and “later” that offer us a reward for that investment.

There will always be something that makes us hesitant and uncertain when investing into stocks, bonds, commodities, etc. (rain-filled clouds). However, uncertainty is precisely the part of investing that allows for our successes. We’re firm believers that you cannot separate risk from return. If you want to be rewarded, you have to take on some level of risk. And the more risk you take on, you will almost always experience 1) higher short-term volatility and 2) higher long-term returns.

In other words, stock investors (company owners) have many things to be uncertain about – company profits, market conditions, inflation, and competition. Bond investors, on the other hand, are really only concerned whether a company can stay solvent enough to pay back their bond debts (which doesn’t always happen, e.g. SVB Bank).

In the investing world, we refer to this as the “risk premium” of an investment, or the amount by which the return of a risky asset is expected to outperform the known return on a risk-free asset. Right now, it can be tempting to pile up the risk-free assets of cash and Treasury bonds, since they’re paying around 4-5%, an incredible amount more than they were paying just last year. At first glance stocks don’t look very compelling in comparison given the large amounts of volatility we’ve experienced.

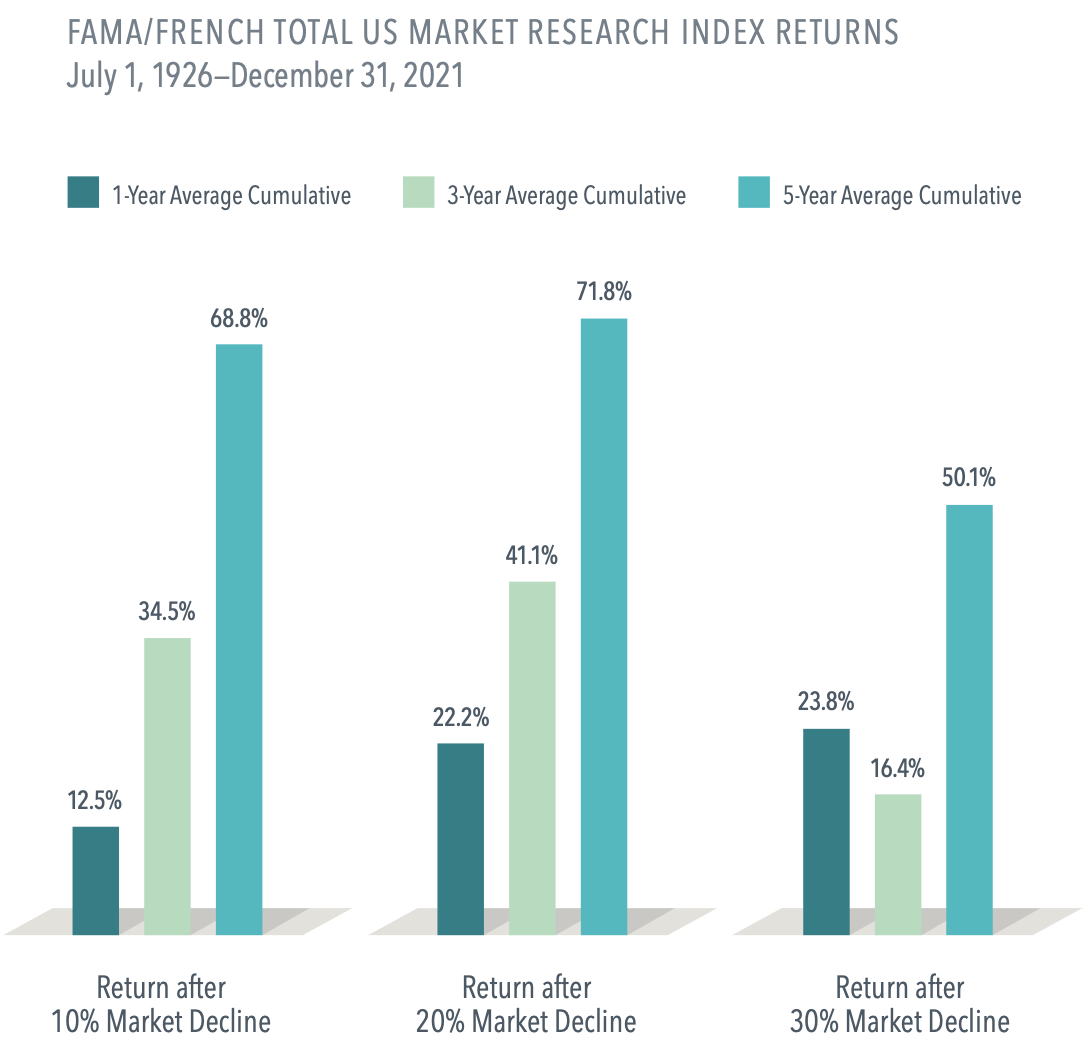

However, it’s important to keep in mind a few things. One is that this risk-free return still isn’t keeping up with inflation and so you’re losing purchasing power even though you’re getting a handsome return on your cash. The other is that with prices being depressed on stocks, there’s statistically a lot of opportunity you could be giving up.

Of course, as you’ve probably guessed by now, these returns are…uncertain! There are no guarantees out there once you leave the certainty of cash and other risk-free investments.

While we have very little knowledge as to what will happen to stocks or bonds this year, this isn’t any different than any other year!

The Policy Uncertainty Index, a group who develops indices of economic policy uncertainty for countries around the world, has tracked the amounts of perceived uncertainty in the markets over time based on headlines, tax provisions, and professional economic forecasters. When you look at data from the past several decades, the lowest recorded measure of uncertainty (i.e. the highest amount of certainty recorded) took place in July of 2007, right before the Global Financial Crisis of 2008.

On the other hand, the American Association of Individual Investors has tracked weekly investor sentiment since 1987. Can you guess the week that it hit the lowest level on history as measured by % of Bearish investors? Yep, it was March 5, 2009, the same week the S&P 500 dipped to its lowest level of the Great Recession.

Since we can’t control or eliminate uncertainty, what should we do with all of this? Bury our head in the sand? Set it and forget it?

For starters, let’s not make certainty an idol. It’s not a bad thing to desire predictability or stability, but when we allow our need for certainty to color our decisions too much, we can be like the servant who buried his talent in the sand. He acted out of fear, and that almost always leads to disobedience and bad decision making.

Second, let’s allow uncertainty to work for us. Tragedy will continue to strike, jobs will be lost, markets will go crazy. But as Warren Buffet has said, it is wise for investors to be “fearful when others are greedy, and greedy when others are fearful.” It’s precisely in times like March of 2009 when we have the most opportunity to grow our investments, much more than the 4-5% we could achieve in risk-free investments.

In fact, since March 5, 2009, the S&P500 has a cumulative return of 533.33%, or an average of 14.00% per year! If you had invested in 3 month Treasury Bills (the standard for risk-free returns), you would have ended up with a cumulative return of only 8.36% through the end of last year! As humans, we’re much more prone to remember negative experiences compared to positive ones. But let’s be intentional about remembering the rewards that all of the uncertainty of investing has brought consistently over time.

Lastly, in this battle of optimism vs pessimism, we need to remember who is ultimately in control. Proverbs 16:9 instructs us that “a man’s heart devised his way: but the LORD directed his steps.” There’s nothing wrong with planning (we are, after all, financial planners!), but we have hold our plans with open hands. Write your plans in pencil, knowing that God holds the eraser! Our ultimate trust has to be in the One who is sovereign. He is the only one who knows the future. He is the only One who is certain. God isn’t wringing His hands, wondering how the markets are going to play out in the next year or two. And mostly, He loves us. Instead of controlling the uncontrollable, let us keep our trust in Him and what He has in store for us.

BACK TO NEWS